Digital Banking Questions

Do I need to re-enroll?

No, you will not need to re-enroll--your account information will carry over to the new system. The first time you log in on either your desktop or through the mobile app, you will need to enter your current username, and the password will be the last 6 digits of your SSN. Just follow the first-time log-in instructions and you will be on your way to using our new Digital Banking.

You may need to re-enroll

- If you have not logged into Digital Banking in over 15 months and your Login ID does not work

- If you have a numerical Login ID

- If you currently have multiple Online Banking Login IDs you will need to re-enroll as you can only have one Login ID/username in the new system

If you are a current mobile app user, you will need to delete our old app download the new version, then follow the same instructions as above.

Download our new app:

How do I log in to the new system for the first time?

The first time you log in on either your desktop or through the mobile app, you will need to enter your current username, and the password will be the last 6 digits of your SSN. Just follow the first-time log-in instructions and you will be on your way to using our new Digital Banking.

You may need to re-enroll

- If you have not logged into Digital Banking in over 15 months and your Login ID does not work

- If you have a numerical Login ID

- If you currently have multiple Online Banking Login IDs you will need to re-enroll as you can only have one Login ID/username in the new system

If you already use our mobile app, you will need to delete our old app and download the new version, then follow the same instructions as above. Note: if you do not have a recurring Bill Pay or transfer setup, you will need to re-enroll.

Download our new app: App Store | Google Play

Will my Login ID/username be changing?

If your current login ID is numeric only, you will be prompted to select a new username when you log in for the first time (note your new login ID must be a minimum of 6 characters and cannot only be numbers). Otherwise, your username from the current system will remain the same.

Please note that on the new system, your Login ID will be referred to as your Username.

Where can I find the Mobile App?

Download our new app:

The Police Credit Union Mobile App requires the minimum operating system listed below.

- Android 8.0 or higher

- iOS 13.0 or higher

Please delete the old version of our app from your phone (the old app icon is a yellow star on a white background). If you are unable to use our new digital banking app because your current device is not supported, you can still conduct your Internet Banking on your mobile device by logging in through our website at www.thepolicecu.org. We have optimized the user experience to minimize any additional resizing or scrolling needed.

What if I have forgotten my Login ID/username?

When you log into our new system for the first time, you'll need your Login ID/username and the last 6 digits of your SSN, which you will enter as your password. We recommend that you verify your login information on our current system before conversion weekend for a seamless experience.

If you have forgotten your current Login ID: Please go to our website and click on Forgot Login ID underneath our Online Banking login box.

You may need to re-enroll

- If you have not logged into Digital Banking in over 15 months and your Login ID does not work

- If you have a numerical Login ID

- If you currently have multiple Online Banking Login IDs you will need to re-enroll as you can only have one Login ID/username in the new system

Please note: In the new system, your Login ID will be called your username.

What if I'm a new user?

You'll be able to enroll in our new system after it launches by clicking on the "Enroll Now" link and following the instructions on screen. To complete registration, you will need your member number and SSN.

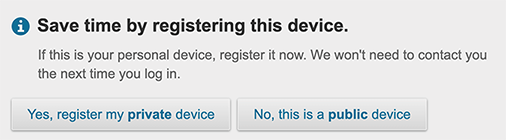

How do I register my personal device and skip the verification code process?

When logging in to Digital Banking for the first time on a new device, you will be prompted to enter a verification code. The verification code process is an extra layer of security to confirm your identity. The code will be sent via text, phone call, or email.

Personal Devices: If you are using a secure, personal device, you have the option of registering the device, allowing you to skip over the verification code the next time you log in.

NOTE: If you clear your browser cache or cookies, you will have to repeat the verification code process until you register your device again.

Public/Shared Devices: For your security, public or shared devices should not be registered.

What happens to my Quicken/QuickBooks transactions?

We are actively working with Intuit to enable connectivity for Quicken users to view their data, and anticipate having connectivity in August. As soon as this is confirmed, we will communicate to our members.

Will Mobile Check Deposit still be available?

Yes, our new mobile app continues to let you deposit checks on your camera-equipped smart phone or tablet.

With the recent Banking system conversion the Credit Union had to make an adjustment to when you receive your Mobile Deposits. All mobile deposited checks that have been verified by the CU will be deposited to your account no more than two hours after submission Monday through Friday from 8am to 5pm. Checks deposited after 5:30pm PST will be reviewed and deposited the next business day. Availability of deposited funds are based on the credit union’s check hold policies.

After depositing a check through our mobile app and receiving a confirmation message, navigate to Check Deposit and tap on the History tab to view the status of your deposit (Pending, Accepted, etc.)

Will I still have access to MoneyTrac?

Yes, you will still be able to access MoneyTrac the way you do currently. Please note: all of your data will not be available in the new system until July 12, 2021.

Will you still provide my FICO score?

Yes, as of August 2021 FICO scores are available in Digital Banking. On desktop, navigate to Account Services > See My FICO Score. In the mobile app, tap on the "More" button in the bottom right corner, then tap on "See My FICO Score."

Is my transaction history going to carry over to the new system?

Yes. Things will look a bit different, but the important information (i.e. Deposits, Withdrawals) will still be included.

You will be able to see two years of account history in Digital Banking by selecting My Accounts and clicking on an account name. You'll be taken to Account History, where you can select a date range.

Why isn't Bill Pay working for me in Safari?

By default, Safari blocks all third-party cookies from being accepted, which may affect certain features in Digital Banking.

If you're accessing Digital Banking from Safari and having issues using Bill Pay, we recommend that you check your cookie settings:

- In your browser, click on Safari > Preferences and check the Privacy tab.

- The option for Block cookies should be set to “Never.”

If you need to change your cookie settings, follow these steps:

- Go the Safari dropdown menu

- Select Preferences.

- Click Privacy in the top panel.

- Under "Block cookies" select the option "Never."

Why don’t I see all my accounts in Bill Pay?

If you are an existing Bill Pay user, you should see all your previously set up accounts with your profile in our new Digital Banking. For example, you have three checking accounts but only one of those was setup within Bill Pay before, you will only see that single checking account and will need to add the others to your Bill Pay profile.

If you are a new Bill Pay user, when you log in you will only see a single account and from there will be able to set up additional accounts as needed.

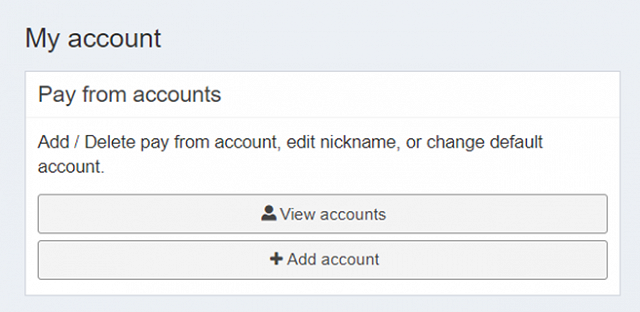

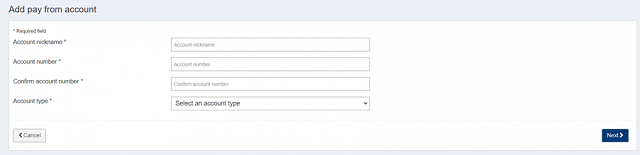

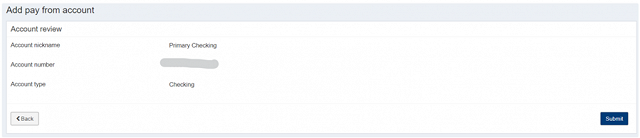

How do I add additional accounts to Bill Pay?

Once you are logged into Digital Banking, select ‘Bill Pay’ then ‘My Account’ and follow the easy steps below:

Step 1: Click on ‘Add account’

Step 2: Complete Required Information.

Step 3: Click ‘Next’

Step 4: Review Information

Step 5: Click ‘Submit’

Step 6: Account is successfully added

I am a current Bill Pay user. Will my payees be transferred over?

Please note that the first time you log in you will be asked to complete your address information, security questions and agree to the Terms and Conditions again, this is required for all Bill pay users (new and existing)

In our new Digital Banking platform, you will notice the experience is slightly different. After you log in to Digital Banking and select Bill Pay, you will be taken directly to the Bill Pay site – we no longer have the interim page that was on our previous platform.

Will I still be able to view check images online?

Yes. You will have the option to view a copy of a cleared check in Digital Banking by selecting My Accounts, clicking on an account name, and clicking on the check number in your account history. However, please note that after we change to our new Digital Banking that you will not be able to view past check images.

How do I make a transfer?

There are many options for transferring funds in Digital Banking. Click on Move Money > Make a Transfer and you'll have the options to set-up one time or recurring transfers to:

- Your accounts at The Police Credit Union

- Accounts you have at other institutions

- Other members of The Police Credit Union

Will my existing external transfers carry over to the new system?

If your transfers were set up as recurring on a scheduled date, then yes.

If not, you will need to set up the transfer(s) again. You will need the account number and the institution’s routing number, then follow the prompts to add your financial institution(s).

How do I update My Settings?

On desktop you can update your settings by navigating to "My Settings" in the upper right corner. In the mobile app you can navigate to My Settings by tapping on More in the bottom right corner, then tapping on the gear icon in the upper right.

My Settings contains account identification information like your username, email address and security phone numbers. You also have the ability to update the fields within this section. My Settings includes:

- Personal information - This is where we display the name registered to the account as well as your masked user id. If applicable, contact information will also display.

- Login & Security - This is your Digital Banking username, password and delivery methods for receiving your verification codes

- Other settings - Features like Rename & Hide accounts, Alerts & Notifications and Text message banking.

How does Digital Banking use cookies?

Cookies are small text files on your system, used to keep track of settings or data for a particular site. Web sites can use cookies to identify a returning user or to pass information between web pages in a single visit.

There are two types of cookies: temporary and permanent. Temporary cookies are used and tracked by the browser to pass information and are deleted once the browser is shut down. Permanent cookies are stored on your system and can be accessed again for multiple visits. Permanent cookies usually have an expiration date and will be automatically deleted from your system at that time. Digital Banking uses temporary cookies and may use permanent cookies, but never passes private information through cookies.

Note: If you have previously registered your personal device, clearing your browser cookies will require you to go through the verification code process the next time you log in to Digital Banking.